The Basic Principles Of Fortitude Financial Group

Table of ContentsWhat Does Fortitude Financial Group Mean?Indicators on Fortitude Financial Group You Need To KnowAll about Fortitude Financial GroupFortitude Financial Group Can Be Fun For EveryoneFascination About Fortitude Financial Group

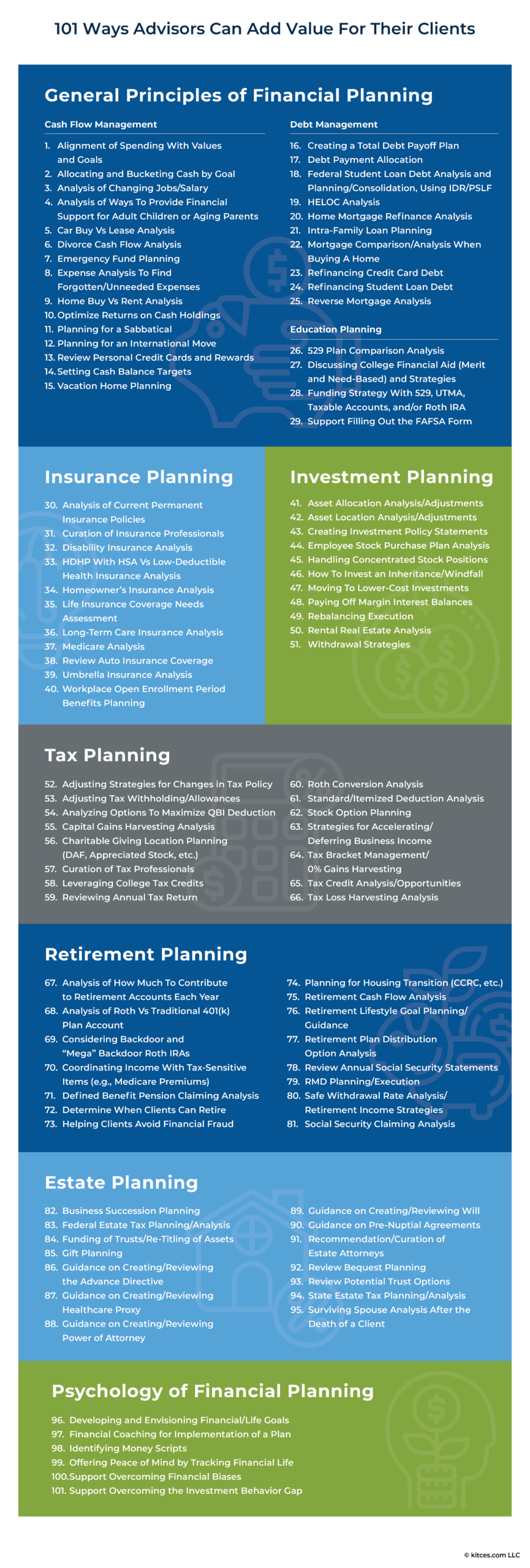

Note that lots of experts won't manage your possessions unless you meet their minimal needs (St. Petersburg, FL, Financial Advising Service). This number can be as low as $25,000, or get to right into the millions for the most special consultants. When picking an economic consultant, locate out if the specific adheres to the fiduciary or suitability standard. As kept in mind earlier, the SEC holds all consultants signed up with the firm to a fiduciary standard.The wide field of robos covers platforms with access to monetary experts and financial investment administration. If you're comfortable with an all-digital system, Wealthfront is another robo-advisor choice.

You can locate a monetary expert to aid with any kind of facet of your monetary life. Financial advisors might run their very own company or they may be part of a bigger office or bank. No matter, a consultant can aid you with everything from developing a monetary plan to spending your cash.

Fortitude Financial Group for Dummies

Inspect that their certifications and skills match the solutions you want out of your advisor. Do you want to discover more concerning economic advisors?, that covers concepts surrounding accuracy, reliability, content self-reliance, competence and neutrality.

Most individuals have some psychological link to their money or the points they acquire with it. This emotional connection can be a primary reason we might make poor financial choices. An expert monetary consultant takes the feeling out of the formula by offering objective recommendations based upon understanding and training.

As you undergo life, there are monetary choices you will certainly make that may be made much more easily with the support of a professional. Whether you are trying to reduce your financial obligation tons or intend to start preparing for some long-term objectives, you might benefit from the solutions of a financial consultant.

The Only Guide for Fortitude Financial Group

The essentials of financial investment monitoring consist of purchasing and selling economic properties and various other financial investments, however it is much more than that. Handling your investments entails comprehending your brief- and long-term objectives and making use of that details to make thoughtful investing choices. A monetary advisor can provide the data essential to aid you diversify your investment portfolio to match your wanted degree of danger and fulfill your economic goals.

Budgeting gives you a guide to just how much money you can invest and just how much you ought to save monthly. Complying with a spending plan will certainly assist you reach your brief- and long-term economic objectives. An economic expert can aid you lay out the action steps to take to establish and maintain a budget that helps you.

In some cases a medical costs or home repair work can unexpectedly include to your debt tons. A professional financial debt monitoring plan assists you settle that debt in the most monetarily helpful means feasible. A monetary consultant can help you examine your financial obligation, prioritize a debt settlement method, give options for financial obligation restructuring, and lay out an alternative plan to far better manage debt and satisfy your future financial objectives.

Fortitude Financial Group Things To Know Before You Get This

Personal cash flow analysis can tell you when you can manage to buy a new auto or just how much money you can include in your financial savings each month without running short for needed expenditures (Financial Services in St. Petersburg, FL). An economic advisor can help you plainly see where you invest your money and after that apply that understanding to assist you understand your monetary wellness and just how to boost it

Threat administration solutions recognize prospective risks to your home, your car, and your family members, and they assist you put the best insurance coverage in area to mitigate those risks. A financial expert can assist you establish a method to shield your gaining power and minimize losses when unanticipated points take place.

See This Report about Fortitude Financial Group

Lowering your tax obligations leaves even more money to add to your investments. Financial Services in St. Petersburg, FL. A financial consultant can help you use charitable giving and financial investment techniques to lessen the amount you have to pay in taxes, and they can reveal you exactly how to withdraw your money in retirement in a manner that additionally reduces your tax burden

Also if you didn't start early, university planning can aid you place your kid with college without dealing with suddenly large expenses. A financial advisor can guide you in comprehending the finest methods to conserve for future university expenses and exactly how to money prospective spaces, discuss how to reduce out-of-pocket college costs, and recommend you on qualification for financial assistance and grants.

Edward Furlong Then & Now!

Edward Furlong Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Monica Lewinsky Then & Now!

Monica Lewinsky Then & Now! Raquel Welch Then & Now!

Raquel Welch Then & Now! Terry Farrell Then & Now!

Terry Farrell Then & Now!